tax avoidance vs tax evasion examples

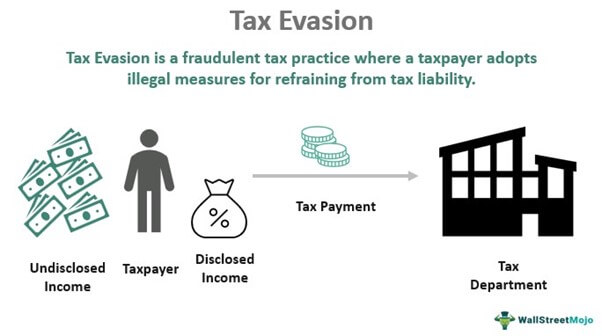

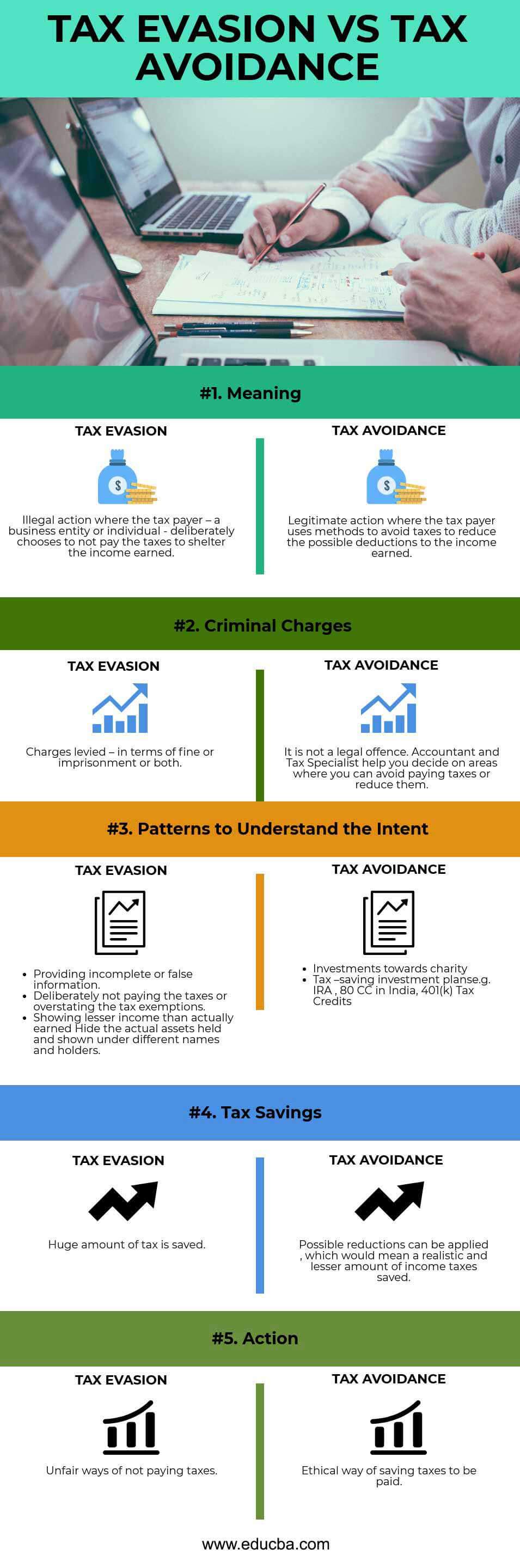

Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or. Fines for tax evasion range from 100000 per year to a one-time payment of 250000 depending on the crime.

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

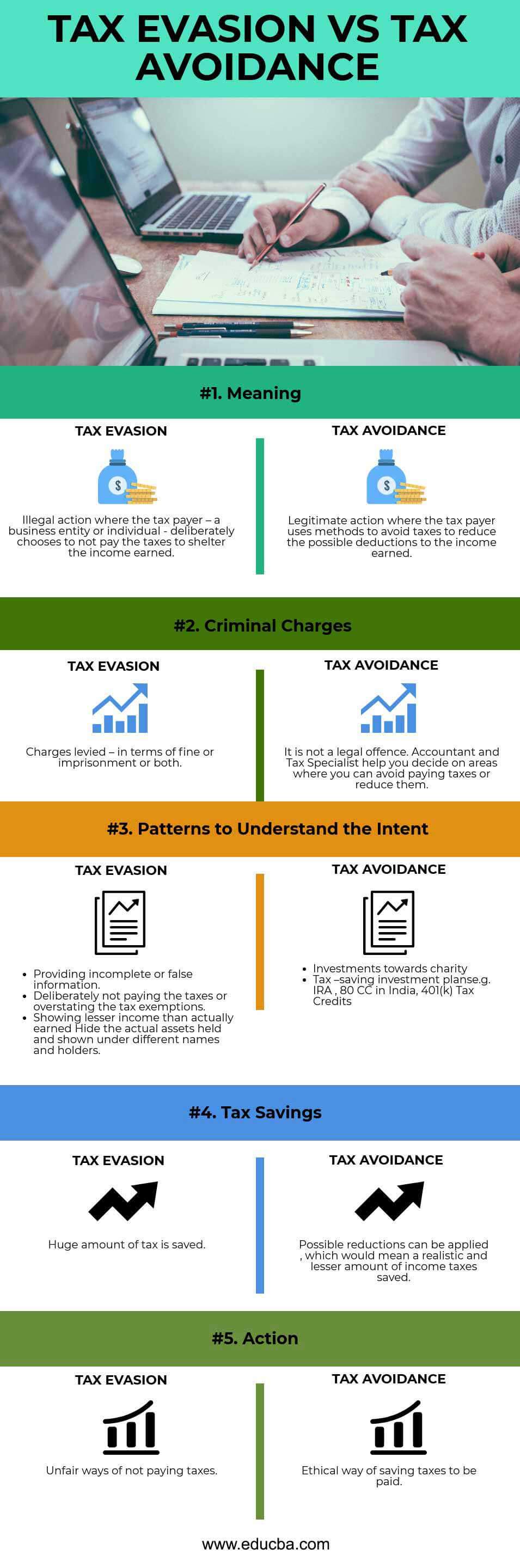

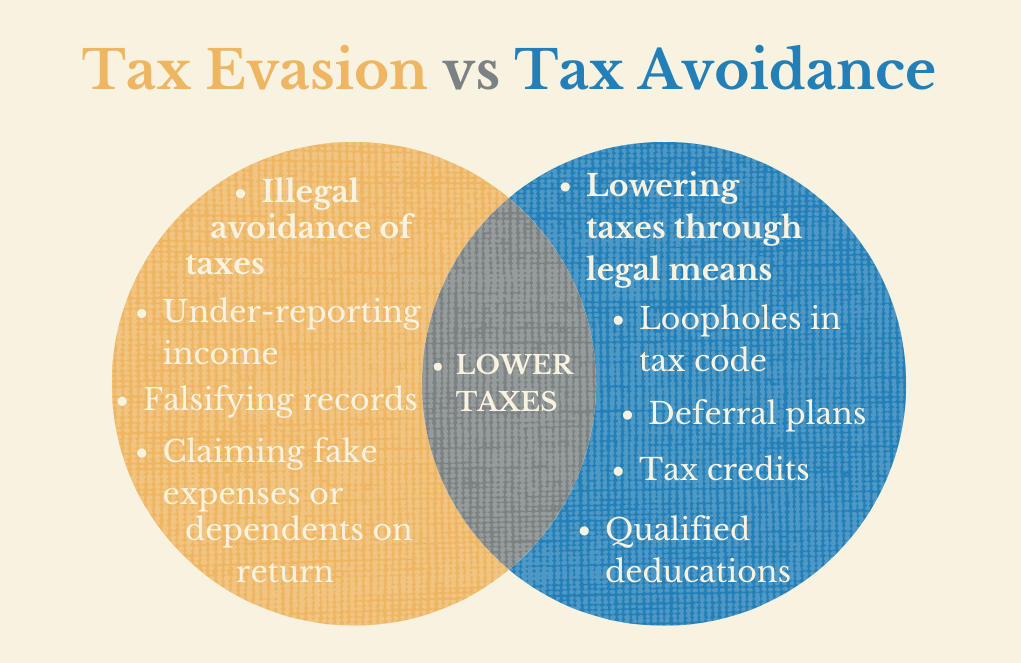

Tax Evasion vs Tax Avoidance.

. Having tax software opens in new tab can help you manage stuff like this legally. Tax avoidance is legal you are arranging your tax affairs in a way to save the most taxes. Depending on where a persons tax evasion crime lands in the set categories they may face a prison sentence of anywhere from one to five years.

This could include travel. Tax evasion is often confused with tax avoidance. You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401k plans.

An example of tax avoidance is a situation where a person owns a business and employs his or her spouse. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes. Examples of tax evasion are.

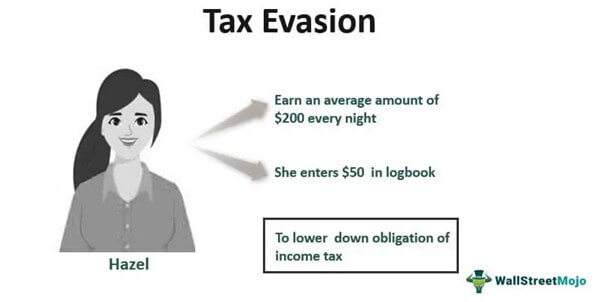

Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of tax evasion. Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions. Ad Register and Subscribe Now to work on your IRS The Difference Between Tax Avoidance Form.

This often affects people with rental properties overseas. Tax evasion is a federal offense. Often taxpayers can overlook their cryptocurrency holdings that have increased in value.

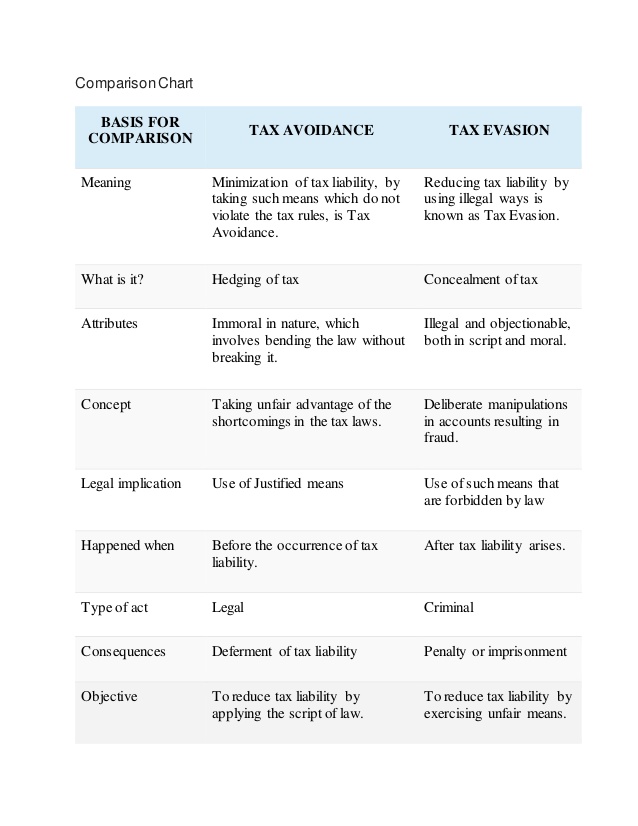

2 Banking on Bitcoin. ï Failing to declare assessable income ï Claiming deductions for expenses that were not incurred or are not legally deductible ï Claiming input credits for goods that Value Added Tax VAThas not been paid on ï Failing to pay the PAYE pay as you earn a form of with holding taxinstallments that have been deducted from a payment for. Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden.

Tax Avoidance Examples Five examples of tax evasion tax fraud and 4 examples of common tax avoidance strategies. Save Time Money With Our Easy-To-Use Affordable Tax Evasion Worksheet. Take advantage of each deduction.

Tax Avoidance vs Tax Evasion. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law. 1 Ignoring overseas income.

An example of an abusive tax avoidance is a sham transaction where a taxpayer structures their tax information to show a situation that is not reflected by reality such as a taxpayer going into business with several business partners to split the income when in reality the business partners are not actually working. Though both the processes reduce the tax amount they differ in legal terms. The IRS will deduct expenses for non-reimbursed business expenses.

Person determines whether the tax planning activities they are. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits.

What is tax evasion. Tax Evasion vs. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax fraud especially in the realm of international and offshore tax aka Tax Evasion.

The IRS has rules about cryptocurrencies and their transactions are taxable. This includes using multiple financial ledgers hiding or. Tax avoidance is when an individual utilizes various legal methods to lessen the total amount of the taxpayers income tax.

Examples of tax evasion. While tax avoidance is a legal way of reducing the tax to be deducted from the gross income tax evasion Tax Evasion Tax Evasion is an illegal act in which the taxpayers deliberately misreport their financial affairs to reduce or evade the actual tax liability. Ad Easily Fill Out Sign Tax Avoidance Forms From Anywhere In The US.

It can be possible when an individual claims different allowable tax deductions and credits to minimize the final tax amount. There are prison sentences and hefty fines. Deductions are a great way to reduce your taxable income.

Here are some examples of tax evasion.

Tax Evasion Vs Tax Avoidance Dsj Cpa

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Tax Avoidance Definition Comparison For Kids

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Tax Avoidance Definitions Differences Nerdwallet

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Lec 2 F 2 Taxation Cess Surcharge Tax Evasion Avoidance For Upsc Other Exam Youtube

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms